annual federal gift tax exclusion 2022

When you file a gift tax return the IRS will decrease your remaining lifetime exclusion amount by the amount of your annual gift tax return. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021.

The gift tax annual exclusion allows taxpayers to make certain gifts without using their lifetime exemption amount.

. The federal estate tax exclusion is also climbing to more than 12 million per individual. That means you can give up to 16000 to as many recipients as you want without having to pay any gift tax. The exclusion is portable and this means that a surviving spouse can use their own exclusion and their deceased spouses exclusion.

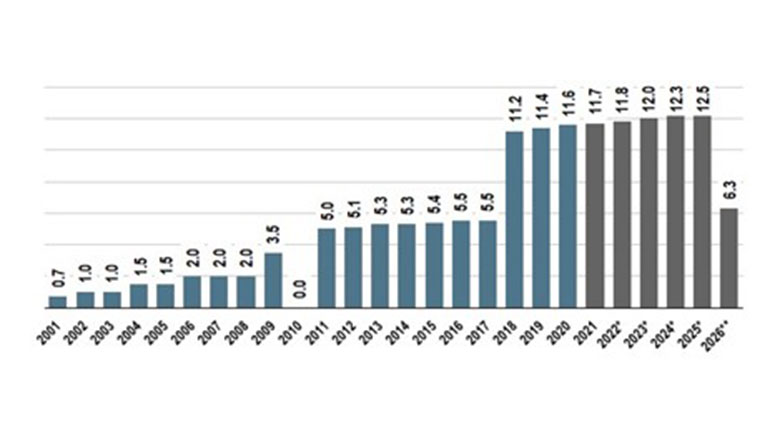

Now is the time for estate planning preparations for 2022 and beyond says a recent article titled The State of Estate Planning 2022 from the New. It sunsets at the end of 2025 when it will be reduced by half. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018.

This is the highest the exemption has ever been. 2022 Annual Gift Tax and Estate Tax Exclusions Increase. The federal estate tax exclusion is also climbing to.

For the first time in several years the annual exclusion from gift tax will increase from 15000 to 16000 per year per donee effective January 1. The amount you can gift without filing a tax return is increasing to 16000 in 2022 the first increase since 2018. In 2018 2019 2020 and 2021 the annual exclusion is 15000.

In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift. Any person who gives away. Exemption amount will increase to match the federal exemption in effect in 2023.

The annual gift exclusion is applied to each donee. The gift tax exclusion for 2022 is 16000 per recipient. For 2018 2019 2020 and 2021 the annual exclusion is.

The amount you can gift to any one person on an annual basis without filing a gift tax return is increasing to 16000 in 2022 the first increase since 2018. The federal estate tax exclusion is also climbing to more than 12 million per individual. If the gifts are made via trust the trust must be written to include a Crummey withdrawal power to qualify as a present.

The annual gift tax exclusion had been 15000 since 2018. The IRSs announcement that the. Marshall Parker Weber.

In 2022 the gift tax annual exclusion increased to 16000 per recipient. In 2022 the annual exclusion is 16000. 4 45 for descendants 12 for siblings 15 for all others.

1 That means if you had the money you could whip out your checkbook and write 16000 checks to your mom your brother your sister your new best friends youll have lots of friends if you start giving away free money and you wouldnt have to pay a gift tax. For married couples this means that they can give 32000year per recipient beginning next year. The annual gift exclusion is applied to each donee.

And for the 2022 tax year the amount incremented to 16000. The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017. The federal estate tax exclusion is also climbing to more than 12 million per individual.

The annual exclusion applies to gifts to each donee. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted numbers.

The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or. The federal estate tax exclusion is also climbing to more. The maximum rate of the federal estate tax is 40 percent so it can have a significant impact on your legacy.

For 2022 the annual exclusion is 16000 per person up from 15000 in 2021. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up any of his or her lifetime gift and estate tax exemption in 2022 1206 million. Outright gifts to recipients qualify for the annual exclusion.

This might be done in a single gift to each child or a series of gifts so long as the annual total to each child is not greater than. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone other than their spouse does not have to report the gift or gifts to the IRS. Many clients make annual exclusion gifts directly to their children and.

For 2022 the annual gift exclusion is being increased to 16000. The annual exclusion for 2014 2015 2016 and 2017 is 14000. The maximum credit allowed for adoptions for tax year 2022 is the amount of qualified adoption expenses up to 14890 up from 14440 for 2021.

The annual exclusion is the aggregate amount of present interest gifts that can be given without using lifetime gift tax exemption. For example assume that in 2022 you give gifts totaling 16000 to each your three children for a total of 48000. 27 rows The Annual Gift Tax Exclusion for Tax Year 2022 The gift tax limit for individual filers.

News Release IR-2021-216 IRS announces 401k limit increases to 20500. The federal per person lifetime estate and gift tax exemption is now 12060000. There have been inflation adjustments each year since then and in 2022 the exclusion is 1206 million.

The annual exclusion 15000 in 2021 and 16000 in 2022 and the lifetime exclusion 117 million in 2021 and 1206 million. Annual Gift Tax and Estate Tax Exclusions Rise in 2022. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up any of his or her lifetime gift and estate tax exemption in 2022 1206 million.

5 From 2022 onward the exemption amount will increase annually in accordance with the cost-of-living adjustment provided in the DC. 9 hours agoIn the 2021 tax year the annual exclusion of gift tax is 15000. Any gift above the exclusion is subject to.

Two things keep the IRSs hands out of most peoples candy dish.

France Cryptocurrency Tax Guide 2021 Koinly

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Increased Us Gift And Estate Tax Exemptions And Further Planning Opportunities In 2022

:strip_icc()/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

What Happened To The Expected Year End Estate Tax Changes

Email Address Best Email Email Address Chosen

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

Tax Tip If I Give Cash To My Kids Is It Tax Deductible In Canada 2022 Turbotax Canada Tips

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Tax Brackets Canada 2022 Filing Taxes

Is Life Insurance Taxable In Canada Moneysense

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax In 2021 How Much Can I Give Tax Free The Motley Fool

Taxation Of Shareholder Loans Canadian Tax Lawyer Analysis

Your Most Common Home Security Questions Answered Accounting Accounting Services Bookkeeping Services